Budget 2025: New vs Old Tax Regime – Which Is Beneficial For You? Choose Wisely

Saturday, 1 February 2025

Saturday, 1 February 2025

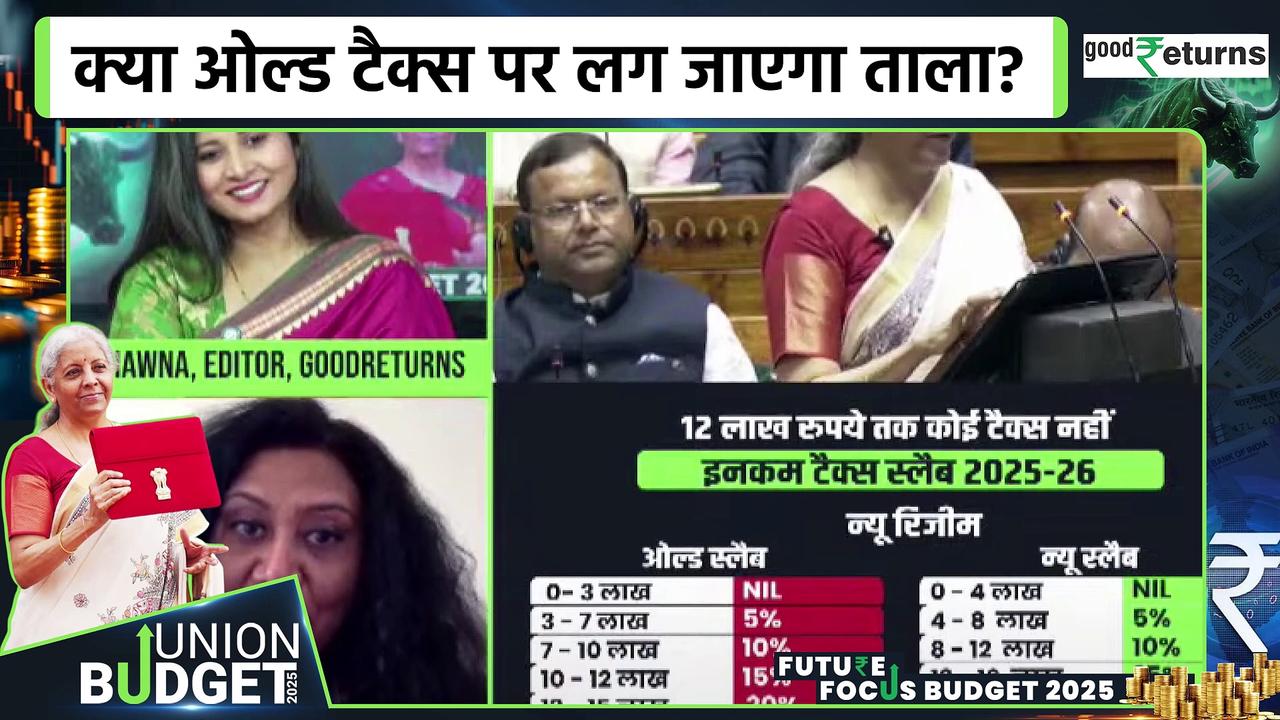

The new tax regime, introduced under Section 115BAC of the Income Tax Act, 1961, was designed to make taxes simpler by offering lower tax rates.

|

|||||

|

|||||

You Might LikeRelated videos from verified sources

Related news from verified sources

|

|||||

![Union Budget 2025 Personal Tax Bonanza: No Income Tax For Those Earning Up to ₹12 Lakh [Video]](https://video.newsserve.net/300/v/20250201/1400439768-Union-Budget-2025-Personal-Tax-Bonanza-No-Income.jpg)