|

Income Tax Slabs FY 2025-26 explained: 20 FAQs individual taxpayers should check to understand tax rates, income tax benefit under new tax regime

![IndiaTimes]() Thursday, 6 February 2025

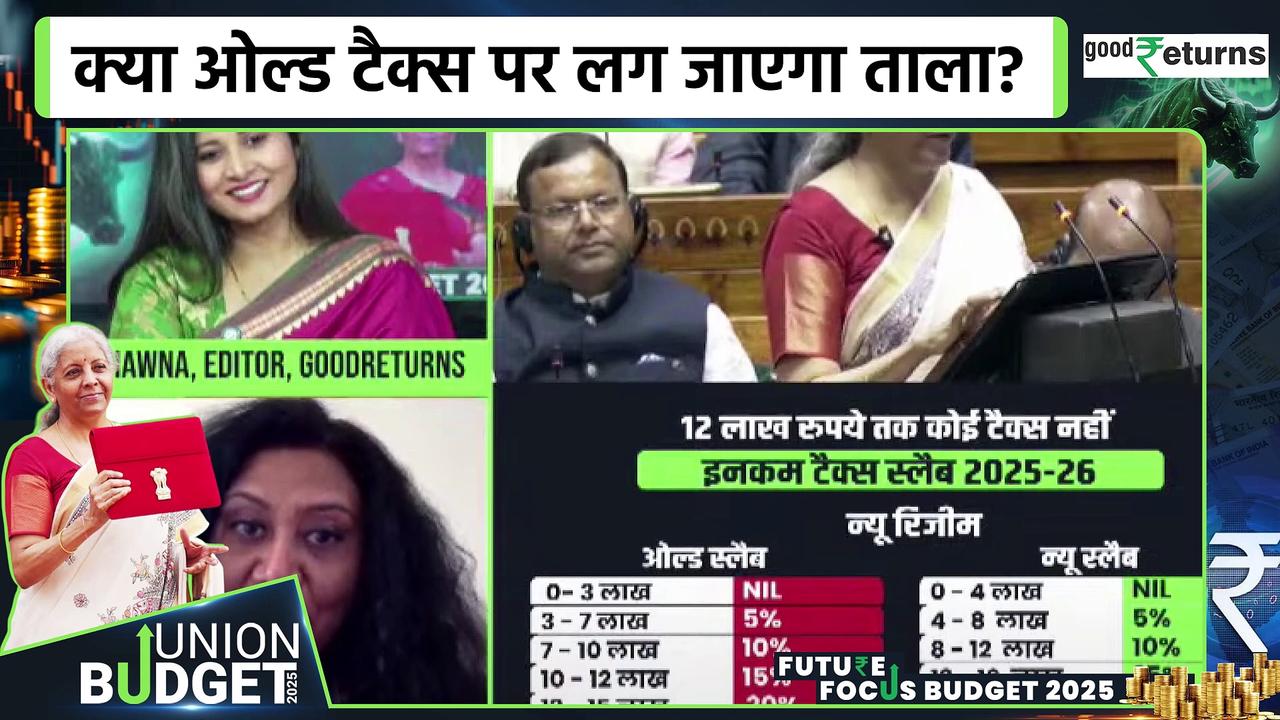

Latest Income Tax Slabs FY 2025-26 after Budget 2025: In the new tax regime for FY 2025-26, individuals earning up to Rs 12 lakh are exempt from paying income tax. A standard deduction of Rs 75,000 for salaried individuals raises this exemption limit to Rs 12.75 lakh. Additionally, reduced tax rates and marginal relief aid those earning slightly above Rs 12 lakh, ensuring lower tax liabilities.

Thursday, 6 February 2025

Latest Income Tax Slabs FY 2025-26 after Budget 2025: In the new tax regime for FY 2025-26, individuals earning up to Rs 12 lakh are exempt from paying income tax. A standard deduction of Rs 75,000 for salaried individuals raises this exemption limit to Rs 12.75 lakh. Additionally, reduced tax rates and marginal relief aid those earning slightly above Rs 12 lakh, ensuring lower tax liabilities.

|

|

|

|

|

|

You Might Like

Related videos from verified sources

Related news from verified sources

|

|

|

Thursday, 6 February 2025

Thursday, 6 February 2025

![Union Budget 2025: FM Ends Budget Speech With Big Income Tax Relief, Youth And Nari The Key Focus [Video]](https://video.newsserve.net/300/v/20250201/1400440846-Union-Budget-2025-FM-Ends-Budget-Speech-With.jpg)

![Union Budget 2025 Personal Tax Bonanza: No Income Tax For Those Earning Up to ₹12 Lakh [Video]](https://video.newsserve.net/300/v/20250201/1400439768-Union-Budget-2025-Personal-Tax-Bonanza-No-Income.jpg)